Melayu Malay 简体中文 Chinese Simplified Guideline for Personal Tax Clearance Form CP21 CP22A CP22B. We retail and provide After-Sales Services for Mercedes-Benz vehicles in Malaysia.

Notes Capital Allowance Capital Allowance Capital Allowance Is A Tax Relief For A Business Who Studocu

Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry.

. Copy of NRIC both sides or Passport including that of supplementary applicants. That said income earned overseas remitted to Malaysia by a resident or individual is exempted from tax. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to.

CYCLE CARRIAGE BINTANG MALAYSIA. Sila lakukan pembayaran caruman segera menerusi Portal ASSIST. As the name implies individual income tax in Malaysia is imposed on earned in Malaysia or received in Malaysia from outside Malaysia.

GST Return Late Payment Fees GSTR 1 and GSTR 3b. Those between 21 to 65 years old. This page is also available in.

In case of Nil GST Return filing the maximum penalty on late filing will be INR 500 250 CGST 250 SGST. The form and instructions are available on IRSgov. In this light every individual is subject to tax on income accruing in or derived from Malaysia.

Please include the following with your application form. Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments. PERKESO tidak akan berkrompomi dalam soal perlindungan sosial kerana keselamatan pekerja merupakan keutamaan kami.

A 5000 fee per tax return applies. 18 years old to 65 years old. As an employer are you aware of the reporting obligations under the Malaysian Income Tax Act 1967.

The Idaho National Guard and descendants of the valleys original tribal population will hold the 11th annual Return of the Boise Valley. If the preceding financial years annual turnover was less than INR15 crore a late fee of up to INR 2000 per report can be levied INR 1000 each for CGST and SGST. Complete the form.

Malaysians and expatriates with a minimum annual income of RM60000.

Registered Mail Domestic Pos Malaysia

Doc Companies Act 1965 Form Of Annual Return Of A Company Having A Share Capital Sarah Razak Academia Edu

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Pin On الهم صل علي سيدنا محمد الفاتح الخاتم الناصر الهادي

Pdf Day Of The Week Effect Annual Returns And Volatility Of Five Stock Markets In Southeast Of Asia

8 Key Updates Of The Companies Act 2016 For Smes In Malaysia Foundingbird

7 Tips To File Malaysian Income Tax For Beginners

Ssm St Partners Plt Chartered Accountants Malaysia Facebook

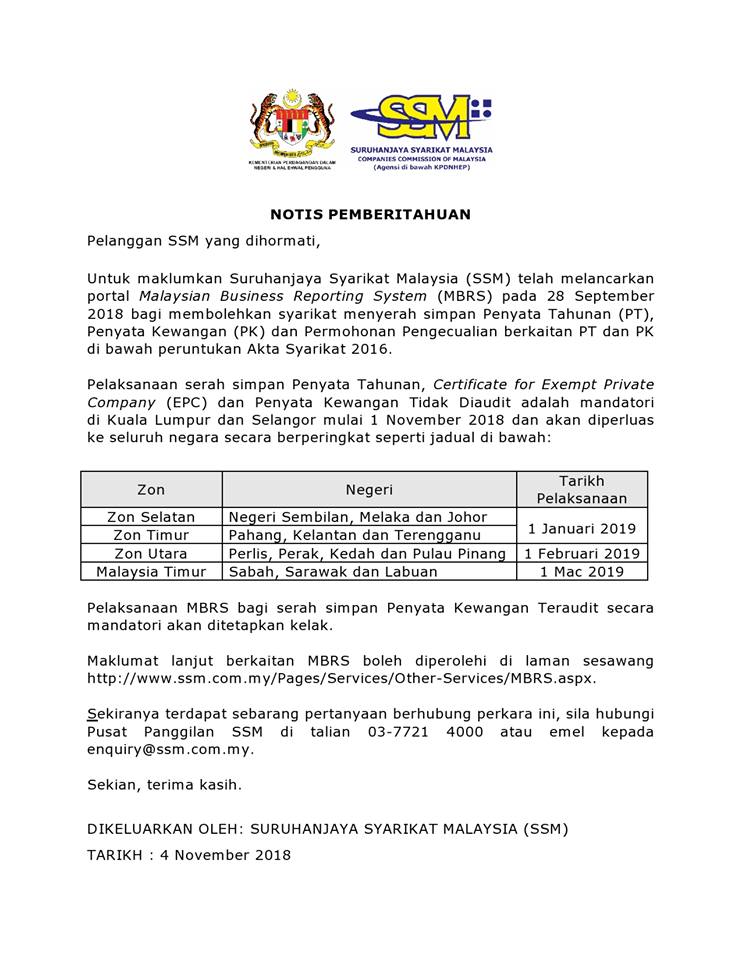

St Partners Plt Chartered Accountants Malaysia Ssm Duty To Lodge Annual Return Dated 31st December 2018 And Financial Statements For The Financial Year Ended 30th June 2018 Facebook

Pdf Listed Property Companies In Malaysia A Comparative Performance Analysis

Hockey Monkey Return Form Form Ead Faveni Edu Br

Editable Annual General Meeting Agenda Template 8 Free Templates In Annual Board Meeting Age Meeting Agenda Agenda Template Meeting Agenda Template

Leave Entitlement In Malaysia Legal Smart Malaysia